My Verizon Connect Internship

UX Research

My work at Verizon Connect as a User Experience Research Intern had me working with the Experience Team to identify and understand patterns of Hum customer onboarding and Hum use. Our goal was to build upon our user experience in a way that bolsters app engagement and supports our users throughout the Hum customer journey.

Overview

Problem

Verizon Connect wishes to better understand Hum user behavior in order to optimize product engagement.

Project Goal

Our team aimed to more completely understand a typical Hum customer journey in order to more effectively allocate resources to the production and sales of the product as well as improve customer satisfaction.

My Contribution

UX Research: interviewing, affinity mapping, survey generation, data storytelling, user journeys

Team

Greg Bosque, Stephen Doerfler, M.S., Lawrence Lee, and Sujit Shrestha, PhD

Employer

Verizon Connect: Experience Team

Timeline

July 1, 2020 - August 7, 2020

Tools

SurveyMonkey, Miro, Google Meets, The Lean Product Playbook

Background

Verizon Connect is a fleet telematics company owned by Verizon Wireless. The company focuses on developing cutting-edge software solutions for fleet management and vehicle tracking. One of Verizon Connect’s primary products is the Hum device, a 4G LTE connected car solution that offers a variety of features, including auto health diagnostic, roadside assistance, location tracking, and many others.

Verizon Connect, and specifically the Experience Team, is constantly looking for methods of improving system usability of its products. During my internship, I worked with a division of the Experience Team called Product Discovery as a qualitative research intern, where I worked with a research mentor, a designer, and and a product manager to better understand Hum user behaviors and provide insights on how to optimize product engagement both with the Hum device and the accompanying Hum application. My internship was remote and took place over the span of 10 weeks during the summer of 2020.

Note: The details of this project’s research and findings are confidential. Some pictures will be blurred, and descriptions of results will be left intentionally vague.

Project Goal

Better understand Hum customers to optimize business expenditure and customer value in Hum.

Project Timeline

My involvement in this project took place from June 1, 2020 to August 7, 2020. The project began just as I began my work and was ongoing at the time my internship ended.

This schedule provides a summarized view of all the research work my team conducted throughout this project.

This project’s main stages, simplified.

This diagram represents how the Lean Product Playbook recommends teams tackle large research projects. We followed these guidelines closely during my time at Verizon Connect, and many of these steps will be discussed in future sections.

Phase 1: Defining Research Intent

Stakeholder Interviews, Goals Alignment, and Hypothesis Generation

The Product Discovery Team at Verizon Connects sits at the very beginning of the company’s problem-solving funnel. All new and unfamiliar problems move through this team before moving to teams that focus on design and development. Many of the problems this team tackles are completely new and un-researched. As a result, we had to begin our work by looking inward and asking our colleagues and leaders how they perceived and understood the problem we were facing.

Stakeholder Interviews

Since the problem we were tackling was relatively new, we had very few existing resources to guide our decision-making process for how to address the problem. The only resource we had, however, turned out to be incredibly valuable: the thoughts and opinions of members of our business who had already identified this problem space as an issue. If we were going to assess and recommend changes to our business, it was intuitive that we make sure our recommendations matched the needs of the people who were asking for them. We conducted eight interviews in total with our coworkers throughout the Verizon Connect business and in a variety of departments (i.e. marketing and product management). Each interview was approximately 30 minutes long.

Research Goals: By communicating with our colleagues, we hoped to identify the most critical priorities and needs of our business in relation to our problem space. By interviewing people from different departments, we would identify different perspectives that would add nuance to our goals. We also hoped to isolate and prioritize asks from leadership specifically as to ensure that our bosses would be satisfied with the project’s direction.

My Contribution: I conducted more than half of the stakeholder interviews and performed the affinity map analysis seen below.

Findings: From this research, we were able to conglomerate our stakeholders’ thoughts into affinity maps. I recommended using affinity maps because it would allow us to categorically sort similar statements and summarize the most important statements made by our colleagues while still allowing us to identify individual statements made by particular stakeholders. We would later take the results of our affinity maps to develop the artifacts we would need for our alignment meeting with those same stakeholders. This process will be discussed in the next section.

We structured our stakeholder interviews around the Lean Product Playbook’s “Problem Canvas.” This method of addressing problems asked our coworkers to distill their thoughts into categories such as Business Problem and Problem Space Benefits. Asking stakeholders to think about the problem in this way allowed them to more clearly articulate their thoughts on some of the more abstract and unclear elements of the problem space.

Here we have the affinity maps I generated from our stakeholder interviews. The yellow sticky notes represent one statement made by a stakeholder. Collections of similar statements are organized under blue sticky notes. The pink sticky notes represent broader categories, and green sticky notes represent a highly generalized area of interest with respect to the Problem Canvas’ questions. There is an affinity map for each question from the Problem Canvas. Also, in order to preserve the identity of the stakeholders within this visualization, I included a smaller, darker blue note next to each blue sticky note. This note listed the names of stakeholders who expressed interest in the blue sticky note’s statement. This labeling allowed us to identify which problems business leaders found particularly important without zeroing in on only the leader’s talking points.

Aligning Priorities and Goals

Once we had organized and identified all our major priorities from the stakeholder interviews, we prepared to hold an alignment meeting. This meeting consisted of all the stakeholders we interviewed in addition to a number of others who did not have time to participate.

Research Goals: The primary goal of the alignment meeting was to get all the stakeholders on the same page with respect to our findings. Once they understood the project’s scope, we asked them to read through the evaluation chart (right) and asked them to vote on the most important initiatives listed. The goal of this voting was to agree upon the most critical elements of the project as a group so that we could proceed with research with the consent and understanding of our stakeholders.

My Contribution: I sat in on the meeting and voted for the most important problem spaces to evaluate.

Findings: At the end of this alignment meeting, we were able to achieve our research goals. We had isolated the most important goals and would move forward with the development of our hypotheses (described later).

This alignment chart shows all our assumptions (developed from our stakeholder interviews) scaled based on the amount of evidence we had to support the assumption and how important they were. Additionally, each assumption is color coded: green represents feasibility, blue represents desirability, and yellow represents viability. This process is recommended by the Lean Product Playbook and helped us to divide our prioritization of assumptions and ensure that we did focus in on too many of one particular type of assumption.

This is a screenshot from the beginning of our alignment meeting. Here we can see the stakeholders being briefed on the intent of the session, how stakeholder interviews were conducted, and how their help is going to inform the next phases of Product Discovery’s research.

Hypothesis Generation

Once we had completed the alignment meeting and acquired the results of the voting, the Product Discovery team met to discuss our findings. We isolated the highest voted assumptions, categorized them based on common themes, and attempted to create a hypothesis that reflected the assumptions for each category.

Research Goals: Following the recommendations of the Lean Product Playbook, we hoped that generating hypotheses would help us direct and validate the success of our research.

My Contribution: I assisted in developing our critical hypotheses.

Findings: There are no findings to report at this point, but these hypotheses would become the foundation for all future research.

A screenshot of our work in Miro to develop hypotheses based on the alignment meeting.

Phase 2: Understanding Target Users

Survey Development and Hypothesis Revision

Upon the generation of our core hypotheses, we had succeeded in aligning our team’s work with the expectations of our stakeholders. As a result, we engaged in the next phase of research; we set out to understand who our target users were so we could more effectively identify and analyze them.

Survey Development

Based on customer behaviors stored in our databases, we were able to pull the emails of the target users we wished to identify. This survey was sent to almost 50,000 customers, and we received feedback from 600 of them.

Research Goals: This research was intended to give us information on customer perception of the Hum product, typical customer behaviors, and customer demographics. We also hoped that this research would inform our development of critical artifacts related to these target customers, such as general behavioral commonalities and personas. Finally, by asking these customers if they would be willing to participate in more research, we were accumulating a list of willing participants for future phases of work.

My Contribution: I assisted in designing the survey flow, writing survey questions, and implementing the survey in SurveyMonkey.

Findings: The findings of this research are confidential, but we achieved our goal of more completely answering our questions about who our target customers were, what portions of the consumer journey were lacking, and how we could start to think about fixing them.

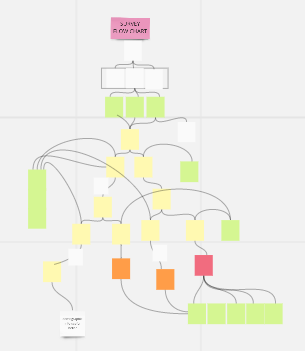

An initial view of our survey flow during brainstorming.

Here is an overview of the survey journey that I developed. The yellow sticky notes denote individual pages in SurveyMonkey, the green stickies denote branching questions, and the lines between yellow sticky notes denote the answer the user must input in order to move to that branch of the survey. This overview was developed to help us better understand our survey flow as well to optimize testing. While not pictured here, I created identical versions of this graphics for each possible path (and equivalently, each type of user moving) through the survey. These visualizations helped us simplify testing the effectiveness of our survey logic and made it easier for my team members, who were not as active in the survey’s development, to understand its design.

Hypothesis Revision

The findings from the survey were our first major interaction with customers. The common behaviors we identified answered and validated a number of our questions in the previous hypotheses.

Research Goals: We used our new knowledge to iterate upon and improve our previous hypotheses based on our new research findings. We hoped that this process would inform our next phase of research experiments into critical areas of interest within the Hum consumer journey.

My Contribution: I assisted in iterating on our critical hypotheses.

Findings: Again, there are no findings to report from hypothesis iteration, but these hypotheses would inform all future phases of research and experimentation.

A screenshot of our work in Miro as we iterated on our first hypothesis based on the findings from our survey.

Phase 3: Interpreting User Needs and Behavior

In Depth Interviews and Data Analysis

The previous phase of research answered our initial questions with respect to who our users were. After completing the previous phase and revising our hypotheses, my co-intern Stephen was working on developing personas based on quantitative demographic findings from the survey. We hoped to build on these personas and tie qualitative needs, interests, and behaviors to their profiles in order to better understand what would motivate and engage them during the consumer journey. The qualitative work was my responsibility.

In Depth Interviews

As mentioned previously, we were able to reference the survey results for participants who were interested in future research. We isolated those individuals and separated them based on their persona. Then, we invited them to participate in a one hour long in depth interview (IDI). We interviewed eight participants in total.

Research Goals: We asked our participants for the details of their respective consumer journeys from the purchase of their Hum device to current day. We probed deeper on questions related to but not inclusive of: in-store experience, installation, Hum usage, general Hum experience, perceptions of price/features/value proposition, etc. We hoped to learn the minutia of individual experiences so that we could find similarities in experiences, validate personas, and reaffirm the best areas for which to promote consumer engagement.

My Contribution: I assisted in developing the interview guide, conducted four interviews, and listened in and assisted with followup question development where needed on the other interviews.

Findings: Many of the findings for this phase of research were confidential, but we achieved our goal of validating personas and generating more complex qualitative views of our customers by persona, described below in Data Analysis.

A picture of my notes from a user interview. While interviewing, I generally take quick notes of key responses but try to write down important followup questions so I remember to ask them.

Data Analysis

This Data Analysis was my final research activity at Verizon Connect. Based on the previous phase of research, Stephen identified three critical persona types relevant for our purposes: Larry, Robert, and Heather. Then, we attempted to present some of our findings and potential solutions to marketing. It did not go as well as we expected. Many of the recommendations that I thought were critically important for certain points in the user journey were discredited. This moment was when I realized that we needed to change how we communicated with other teams within the organization. Instead of presenting solutions and asking for feedback, we needed to present the moments in the consumer journey we deemed as critical for promoting continued consumer engagement and ask for help generating viable solutions. Simply proposing solutions when the audience did not understand the context or importance of having solutions at certain phases of the consumer journey would hinder the effectiveness of our solution generation and collaboration overall.

Based on this realization, I asked Greg if I could work with him to generate consumer journeys for each persona based on the survey and interview findings. With his help to develop the ideal timeline for the journeys, I drew on the information from all previous research to generate a consumer journey that included: journey milestones (yellow), emotions (emojis with green sticky notes), observations and effects of milestones (red), and solution ideas (orange). Had I had more time, I would have iterated on these consumer journeys to make them more visually appealing and include more call outs to the most important areas for improvement.

My Contribution: I recommended and developed the consumer journeys for all our target personas.

This image shows the consumer journeys developed based on our interviews. These journeys were particularly effective in showing the gaps in interaction - the most important areas for improvement within our journeys - as well as critical interactions and how they affect customer emotions/satisfaction.

Reflection

A picture of an award I received from my Verizon Connect team for National Intern Day. It was efforts like these that truly made me feel valued during my time on the Experience Team!

This internship was truly a transformative experience for me. It was such an amazing experience to work on important and influential projects that were generating actual value for Verizon Connect’s business. I got to meet with and interview key leaders in the business as well as lead conversations with real Hum users. This work helped me gain confidence in my skills as a researcher and help me to validate my passion for research.

Not only did I love my work, but I also loved my team. My manager, Cheryl Abellanoza, is one of the best in the business. She leads with a perfect balance of communicating expectations, trusting and respecting her team, and doling out positive feedback where it is due. Thanks to her guidance, I have decided to take a crucial next step within my education: I will be pursuing a Management of Technology Certificate from Georgia Tech in addition to my M.S. in HCI in the hopes that I can leverage my management and organization skills to their fullest as a researcher. If I eventually do decide to pursue management in the UX field, I will lean heavily on what I learned from working with Cheryl to inform my management style.

With respect to research, this internship taught me of the flexibility and effectiveness of the research process. I genuinely felt that my experience was not hindered at all by the remote model. Miro provided us with all the resources we needed to complete research activities effectively and collaboratively, and the willingness and flexibility of all my colleagues to participate in Google Meets video calls made us feel almost as close as being in the office. Additionally, I learned about an insecurity that I had been harboring all this time as a researcher: I typically struggled to trust the research process to deliver results. When I was working on previous projects, the dPod for example, I was very anxious that the initial exploratory research phases would generate very little to no valuable findings. While working here with my research buddy Sujit, however, I found someone with a vast knowledge of research experience who showed me that trusting an effective and validated research process will always lead to valuable findings and actionable next steps. With this newfound realization, I will approach future research endeavors with a newfound faith in the process and trust in the users who will guide us to our “truth.”

This portfolio piece is dedicated to the Verizon Connect Experience Team. You all were an absolute pleasure to work with, and I will be eternally grateful for the guidance, experience, and support you instilled in me. I would also like to thank the amazing intern team this summer: Amy An, Mimi Lu, Stephen Doerfler, and Olivia Lawson. Thank you all for your friendship, and I sincerely hope we will work together again someday.

And finally thank you, reader, for coming along on this journey with me.

Check out some of my other work below.